11th Standard Accountancy Subject Question Paper Software Subscription

QB365 covers complete information about Tamilnadu 11th Standard 2024-2025 Accountancy Subject. Question Bank includes 11th Standard 2024-2025 AccountancySubject Book back questions, other important questions, Creative questions, Extra questions, PTA questions, Previous Year asked questions and other key points also. All question with detailed answers are readily available for preparing Accountancy question papers.

All Chapters Covered

Create Unlimited Question Papers

Access anywhere anytime

Multiple Pattern Question Papers

Share your Question Paper

Font size, line spacing, watermark etc,

Other Subjects for Tamil Nadu State Board 11th Standard

11th Standard Accountancy English Medium Chapters / Lessons 2024-2025

Introduction to Accounting

Conceptual Framework of Accounting

Books of Prime Entry

Ledger

Trial Balance

Subsidiary Books - I

Subsidiary Books - II

Bank Reconciliation Statement

Rectification of Errors

Depreciation Accounting

Capital and Revenue Transactions

Final Accounts of Sole Proprietors - I

Final Accounts of Sole Proprietors - II

Computerised Accounting

Rectification of Errors

Depreciation Accounting

Capital and Revenue Transactions

Final Accounts of Sole Proprietors - I

Final Accounts of Sole Proprietors - II

Computerised Accounting

11th Standard Accountancy English Medium Chapters / Lessons 2024-2025 Syllabus

Introduction to Accounting

Introduction-Evolution of Accounting-Meaning and Definition of Accounting-Accounting Cycle-Objectives of Accounting-Functions of Accounting-Importance of Accounting-Basic Accounting Terminologies-Branches of Accounting-Bases of Accounting-Users of Accounting Information-Role of an Accountant

Conceptual Framework of Accounting

Book-keeping-An Introduction-Book-keeping Vs. Accounting-Relationship among Book-keeping, Accounting and Accountancy-Accounting Principles-Accounting Standards (AS)-International Financial Reporting Standards (IFRS)-Accounting Standards in India

Books of Prime Entry

Introduction-Source Documents-Double Entry System-Transaction-Account-Approaches of Recording Transactions-Accounting Rules-Journal Entries

Ledger

Introduction-Utilities of Ledger-Format of Ledger Account-Distinction between Journal and Ledger-Procedure for Posting-Balancing of Ledger Accounts

Trial Balance

Introduction-Need for Preparing Trial Balance-Definition of Trial Balance-Features of Trial Balance-Objectives of Preparing Trial Balance-Limitations of Trial Balance-Methods of Preparing Trial Balance-Suspense Account

Subsidiary Books – I

Introduction-Meaning of Subsidiary Books-Types of Subsidiary Books-Advantages of Subsidiary Books-Purchases Book-Purchases Returns Book-Sales Book-Sales Returns Book-Bills of Exchange-Bills Receivable Book-Bills Payable Book-Journal Proper

Subsidiary Books – II

Introduction-Meaning of Cash Book-Cash Book – A Subsidiary Book and Principal Book of Accounts-Importance of Cash Book-Types of Cash Book-Single Column Cash Book-Cash Discount and Trade Discount-Double Column Cash Book-Three Column Cash Book-Petty Cash Book

Bank Reconciliation Statement

Introduction-Bank Reconciliation Statement (BRS)-Reason why Bank Column of Cash Book and Bank Statement may Differ-Preparation of Bank Reconciliation Statement

Rectification of Errors

Introduction-Meaning of Errors-Errors at Different Stages of Accounting-Classifications of Errors-Errors Disclosed by the Trial Balance and Errors Not Disclosed by the Trial Balance-Steps to Locate Errors-Suspense Account-Rectification of Errors-Errors in Computerised Accounting

Depreciation Accounting

Introduction-Depreciation – Meaning and Definition-Objectives of Providing Depreciation-Causes of Depreciation-Characteristics of Depreciation-Factors Determining The Amount of Depreciation-Methods of Providing Depreciation-Methods of Recording Depreciation-Calculation of Profit or Loss on Sale of Asset

Capital and Revenue Transactions

Introduction-Considerations in Determining Capital and Revenue Expenditures-Classification of Expenditure-Capital Expenditure-Revenue Expenditure-Deferred Revenue Expenditure-Comparison of Capital, Revenue and Deferred Revenue Expenditure-Capital and Revenue Receipts-Distinction between Capital and Revenue Receipts

Final Accounts of Sole Proprietors – I

Introduction-Closing Entries and Opening Entry-Trading Account-Profit and Loss Account-Balance Sheet-Difference between Trial Balance and Balance Sheet

Final Accounts of Sole Proprietors – II

Introduction-Adjustment Entries and Accounting Treatment of Adjustments-Summary of Adjusting Entries and Accounting Treatment of Adjustments-Final Accounts with Adjustments

Computerised Accounting

Introduction-Computerised Accounting System (CAS)-Advantages of Computerised Accounting System-Limitations of Computerised Accounting System-Differences between Manual and Computerised Accounting System-Accounting Software-Grouping and Codification of Accounts-Microsoft Office-MS Word and MS Excel Practical

Features in Question Paper Preparation software

(or) type Question

Add or Remover

Sub Questions

Adding Notes

Multiple Pattern

All subjects available

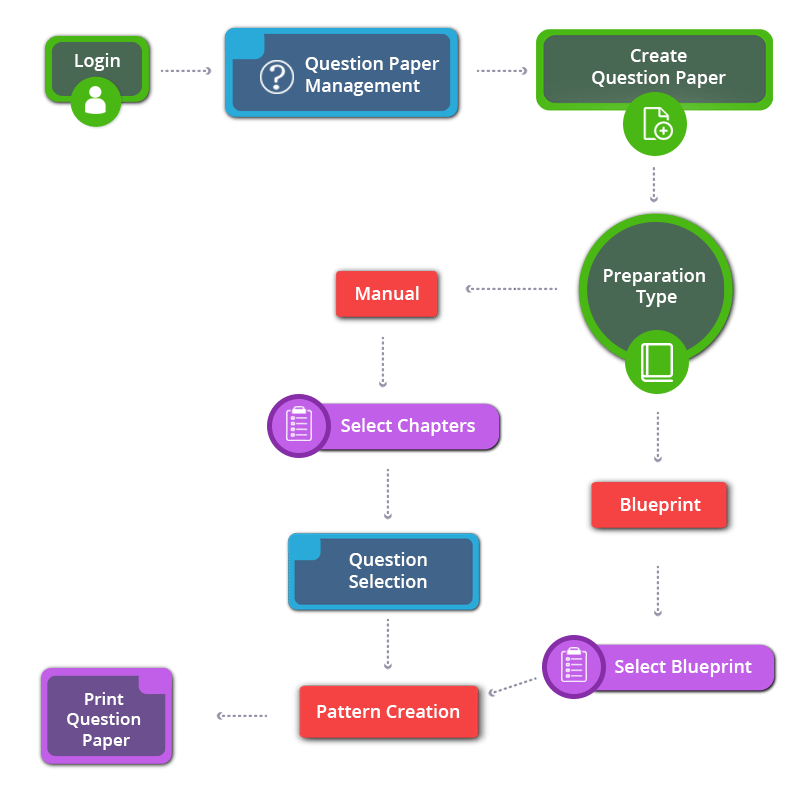

How to Create 11th Standard Accountancy English Medium Question Paper

11th Standard Accountancy English Medium Chapters / Lessons 2024-2025

- Covers all chapters

- Unique Creative Questions

- Unlimited Question Paper

- Multiple Patterns & Answer keys

3332

2999