12th Standard Accountancy Subject Question Paper Software Subscription

QB365 covers complete information about Tamilnadu 12th Standard 2024-2025 Accountancy Subject. Question Bank includes 12th Standard 2024-2025 AccountancySubject Book back questions, other important questions, Creative questions, Extra questions, PTA questions, Previous Year asked questions and other key points also. All question with detailed answers are readily available for preparing Accountancy question papers.

All Chapters Covered

Create Unlimited Question Papers

Access anywhere anytime

Multiple Pattern Question Papers

Share your Question Paper

Font size, line spacing, watermark etc,

Other Subjects for Tamil Nadu State Board 12th Standard

12th Standard Accountancy English Medium Chapters / Lessons 2024-2025

Accounts From Incomplete Records

Accounts of Not-For-Profit Organisation

Accounts of Partnership Firms-Fundamentals

Goodwill In Partnership Accounts

Admission of a Partner

Retirement and Death of a Partner

Company Accounts

Financial Statement Analysis

Ratio Analysis

Computerised Accounting System - Tally

12th Standard Accountancy English Medium Chapters / Lessons 2024-2025 Syllabus

Accounts From Incomplete Records

Introduction - Meaning of incomplete records - Features of incomplete records - Limitations of incomplete records - Differences between double entry system and incomplete records - Accounts from incomplete records - Ascertaining profit or loss from incomplete records through statement of affairs - Preparation of final accounts from incomplete records

Accounts of Not-For-Profit Organisation

Introduction - Features of not-for-profit organisations - Receipts and Payments Account - Items peculiar to not-for-profit organisations - Income and Expenditure Account - Balance Sheet

Accounts of Partnership Firms-Fundamentals

Introduction - Meaning, definition, and features of partnership - Partnership deed - Application of the provisions of the Indian Partnership Act, 1932 in the absence of partnership deed - Final accounts of partnership firms - Methods of maintaining capital accounts of partners - Interest on capital and interest on drawings of partners - Salary and commission to partners - Interest on loan from partners - Division of profits among partners - Profit and loss appropriation account

Goodwill In Partnership Accounts

Introduction - Nature of goodwill - Factors determining the value of goodwill of a partnership firm - Need for valuation of goodwill of partnership firms - Classification of goodwill - Methods of valuation of goodwill

Admission of a Partner

Introduction - Adjustments required at the time of admission of a partner - Distribution of accumulated profits, reserves and losses - Revaluation of assets and liabilities - New profit sharing ratio and Sacrificing ratio - Adjustment for goodwill - Adjustment of capital on the basis of new profit sharing ratio

Retirement and Death of a Partner

Introduction - Adjustments required on retirement of a partner - Distribution of accumulated profits, reserves and losses - Revaluation of assets and liabilities - Determination of new profit sharing ratio and gaining ratio - Adjustment for goodwill - Adjustment for current year's profit or loss upto the date retirement - Settlement of the amount due to the retiring partner, Death of a partner - Adjustments required on the death of a partner

Company Accounts

Introduction - Meaning and definition of a company - Characteristics of a company - Meaning and types of shares - Divisions of share capital - Issue of equity shares - Process of issue of equity shares - Issue of shares for cash in instalments - Issue of shares for cash in lumpsum - Issue of shares for consideration other than cash

Financial Statement Analysis

Introduction - Financial statements - Financial statements of companies - Financial statement analysis - Tools of financial statement analysis - Preparation of comparative statements - Preparation of common - size statements - Trend analysis

Ratio Analysis

Introduction - Meaning of accounting ratios - Meaning and definition of ratio analysis - Objectives of ratio analysis - Classification of ratios - Computation of ratios - Advantages of ratio analysis - Limitations of ratio analysis

Computerized Accounting System-Tally

Introduction - Applications of Computerised Accounting System (CAS) - Automated accounting system - Designing the accounting reports - Data exchange with other information system - Application of computerised accounting system - Tally with GST package - Practical application of accounting software - Tally.ERP 9

Features in Question Paper Preparation software

(or) type Question

Add or Remover

Sub Questions

Adding Notes

Multiple Pattern

All subjects available

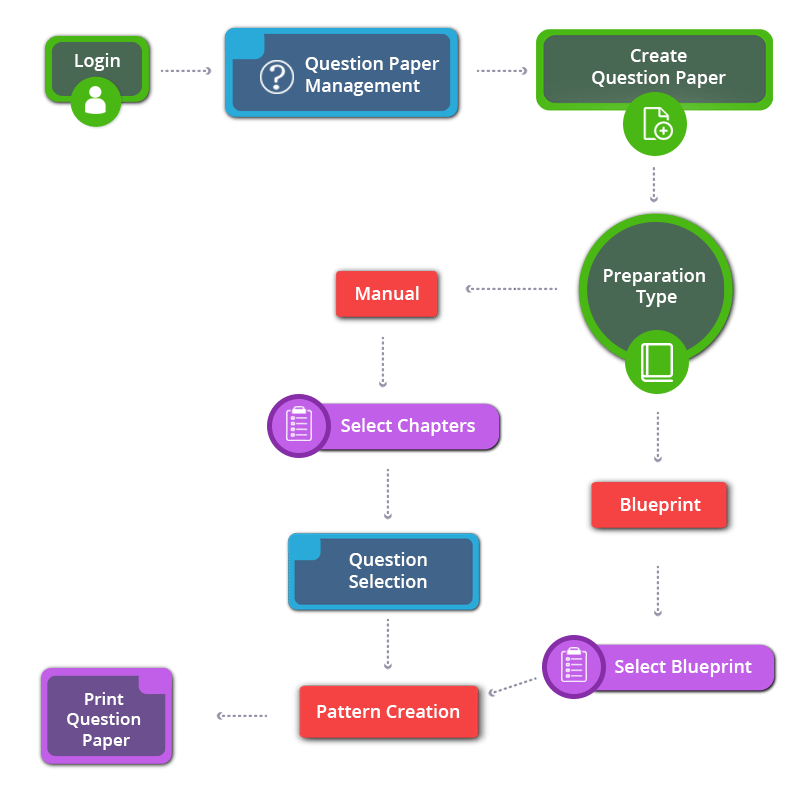

How to Create 12th Standard Accountancy English Medium Question Paper

12th Standard Accountancy English Medium Chapters / Lessons 2024-2025

- Covers all chapters

- Unique Creative Questions

- Unlimited Question Paper

- Multiple Patterns & Answer keys

1665

1499